Driving behavior data: The new frontier for smarter auto insurance pricing Read article

Distracted driving is on the rise, and unfortunately, new in-car technology among other factors, could potentially accelerate that epidemic. As self-driving capabilities and third-party app infotainment integrations – like Tik Tok and Zoom – become more prevalent in vehicles, we all need to re-consider what we can do to curb distracted driving right now.

Carriers have the capability to reduce distracted driving by motivating safe behaviors behind the wheel. Auto insurance was born out of a need to protect drivers from the financial losses caused by car accidents – a very important service considering crashes cost U.S. society $340 billion a year.

But what if carriers take that ambition one step further, protecting drivers from crashes in the first place? Here are our recommendations for auto insurers looking to curb distracted driving in 2024.

Before carriers can take action to curb distracted driving, they need to understand when, where, and why it’s most likely to take place. Otherwise, strategies to stop and prevent distracted driving are only guesses.

To help companies, organizations, and individuals navigate this epidemic, Arity shares its insights around distracted driving each year. By analyzing phone handling behind the wheel, which is only one of the many driving behaviors we’re able to identify and quantify, we found that distracted driving…

In 2023, specifically, distracted driving…

While these statistics are a great start to understand the state of distracted driving, carriers have an opportunity to get even more specific and relevant insights with Arity’s insurance solutions. Built from the largest telematics database tied to claims, our solutions can collect and analyze the driving behaviors of your current customers as well as prospects.

With key driving behavior insights, carriers can make informed decisions on how to take action against distracted driving.

From the very beginning of a customer’s journey, carriers can start to emphasize and incentivize safe driving behaviors.

With Arity Marketing Solutions, auto insurance marketers can reach their ideal prospect customers based on how, when, and where they drive. So, what does this look like? Marketers can programmatically target drivers with the lowest rates of distracted driving and reward them a discounted rate on their policies.

The two-fold benefits? By advertising a tangible reward for safe driving – i.e. discounted rates – carriers are encouraging safe drivers to continue their safe driving habits as well as increasing customer lifetime value with a fairer, more accurate rate.

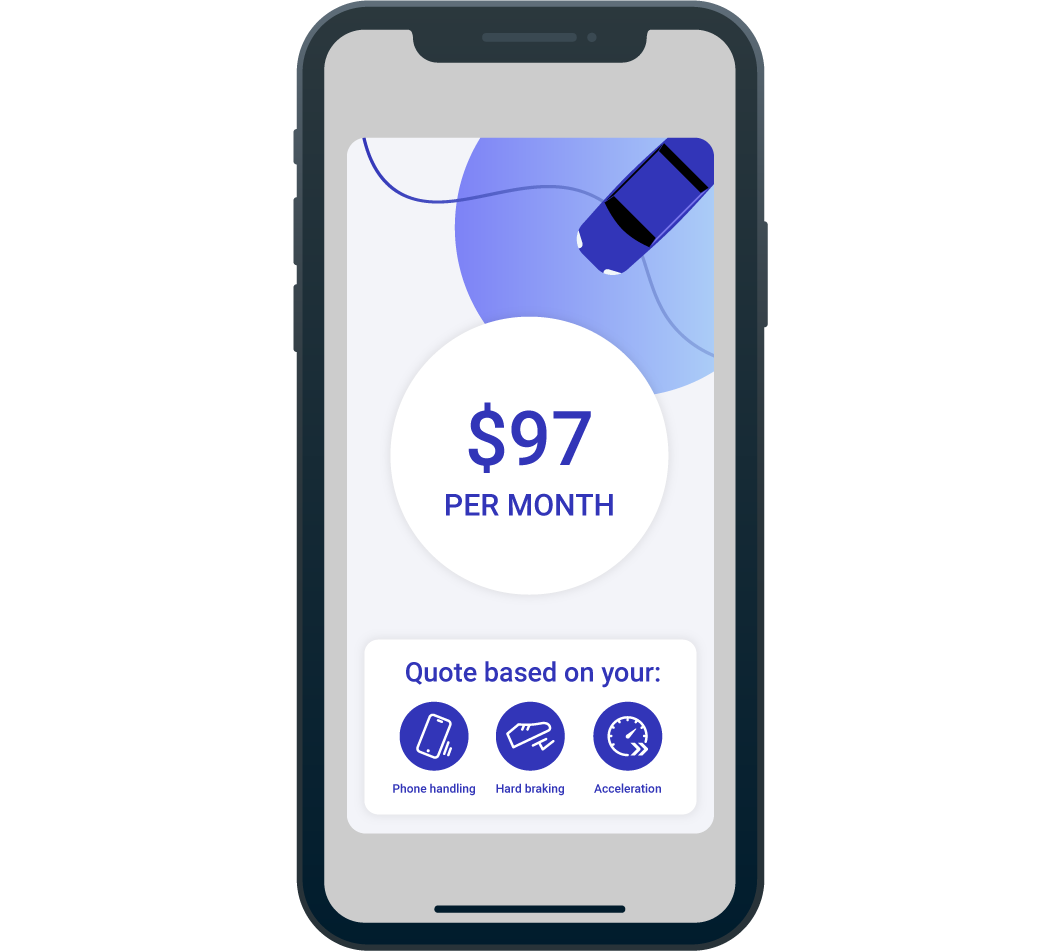

Similarly, the Arity IQ℠ network provides the same benefits by allowing carriers to pull a person’s driving score, based on their actual driving behaviors, at time of quote. And with driving attributes available in real time from Arity IQ®, carriers can put more emphasis on certain driving behaviors, like phone handling, in a driver’s overall score.

If someone is a safe driver, they can be encouraged to continue to keep their discounted rate. If someone is a risky driver, they can be influenced to be a safer driver if there’s a tangible reward like a future discount for a better driving score.

Motivating safe driving behaviors doesn’t have to stop at the initial policy. In fact, it should continue throughout the customer journey.

As an auto insurer, you can help riskier drivers become safer drivers with our Routely® app or Arity SDK within your own branded app. Through these solutions, you can coach drivers to decrease risky behaviors behind the wheel – not only phone handling, but also speeding, hard braking, rapid acceleration, and more.

You can also continuously incentivize customers to drive more safely with the potential to gain premium savings which may prevent losses, injuries, and even fatalities. Again, this is not only an opportunity to improve your bottom line with less claims, but also a chance to keep your customers safe and improve transportation overall.

In 2020, we helped Southern Farm Bureau Casualty Insurance Company (SFBCIC) launch its telematics program, DriveDown. Through this program, SFBCIC provides feedback about how a person drives, rewarding customers for safe driving behaviors with a reduced policy deductible. After just 30 days, over 20% of its drivers reduced their distracted driving by more than 50%.

Our team loves to see our solutions in action, rewarding safer driving and enabling fairer, more accurate pricing.

Last year, Texas Farm Bureau Insurance leveraged our scoring model, Drivesight®, to power its new telematics program, Drive’n Save.

Wtih Drive’n Save, customers can download the carrier’s mobile telematics app and be priced based on how and how much they drive. The program offers drivers 10% off their premium just for participating with deeper discounts available for those who continue to demonstrate safe driving behaviors.

“Promoting safe driving and providing discounts to our members are top of mind for Texas Farm Bureau Insurance. We are always looking for ways to improve the way we service our members and provide them with the best coverage and solutions. With Arity’s long legacy and proven expertise in insurance telematics and wealth of data insights, there is no better partner to deliver the experience, accuracy, transparency, and rewards that our customers deserve – including discounts for driving safely.”

– Minesh Patel, Director of Pricing for Texas Farm Bureau Insurance

Ready to motivate safe drivers and join the future of auto insurance? Let’s start a conversation.