Video

Routely® overview

Auto insurers, do you need a better way to effectively measure and quantify risky driving behaviors?

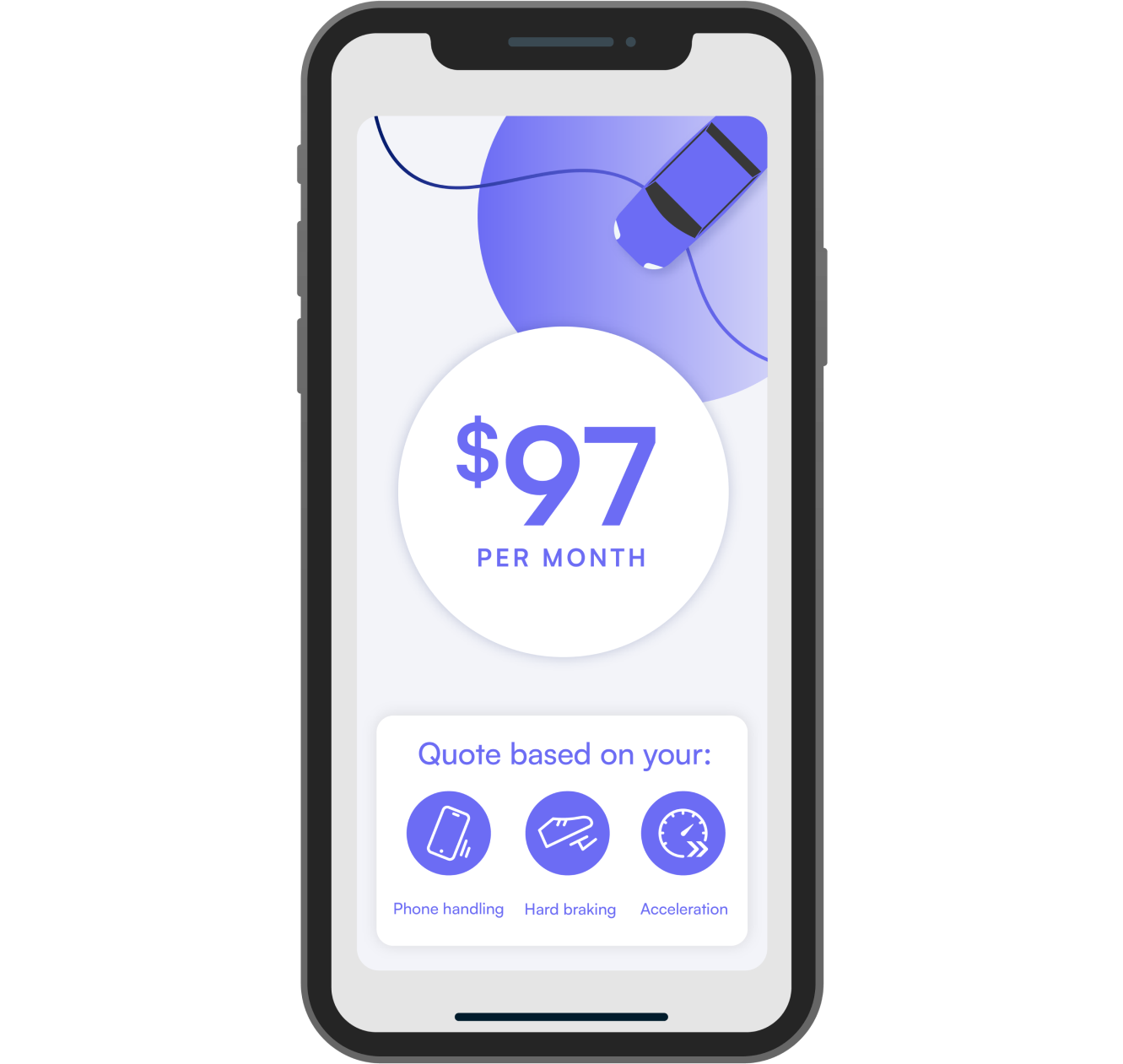

Our Routely® app enables you to capture telematics data while creating a brand-specific experience for your customers. Here’s how.