Case study

National General

Implementing telematics

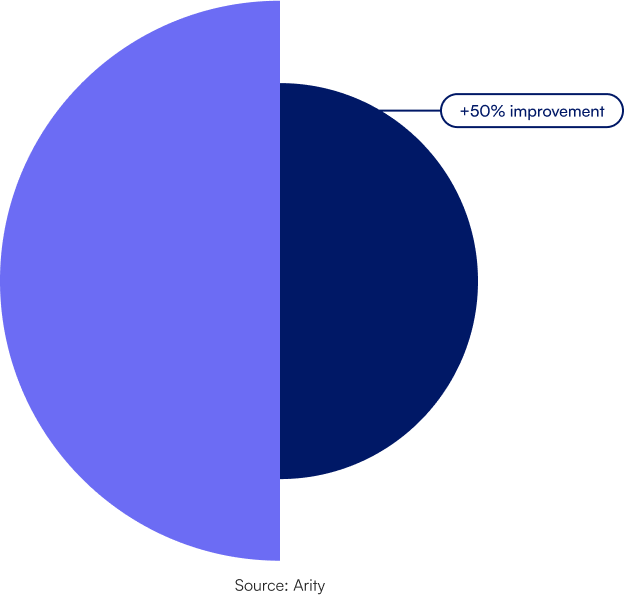

Leveraging our Routely® app and Drivesight® driving score, National General launched its branded telematics program quickly and effectively.