5 ways to “turbo-charge” auto insurance telematics Read article

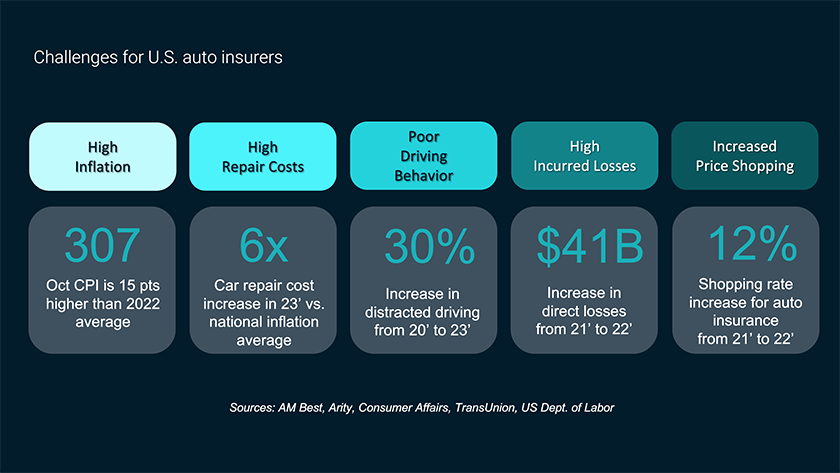

High inflation, soaring repair costs, riskier driving behaviors, elevated incurred losses, and heightened price shopping all contribute to the challenging environment facing auto insurers today. The illustration below underscores just how severe these headwinds are for the industry. And auto insurance telematics may be the solution.

It’s not surprising that many carriers are still resorting to rate increases to combat these challenges.

With ongoing concerns about return on investment, technical complexities, internal training and support, or consumer apprehensions about data privacy, there are far too many auto insurers who continue to rely on traditional indicators such as credit scores and driving records in their rating models.

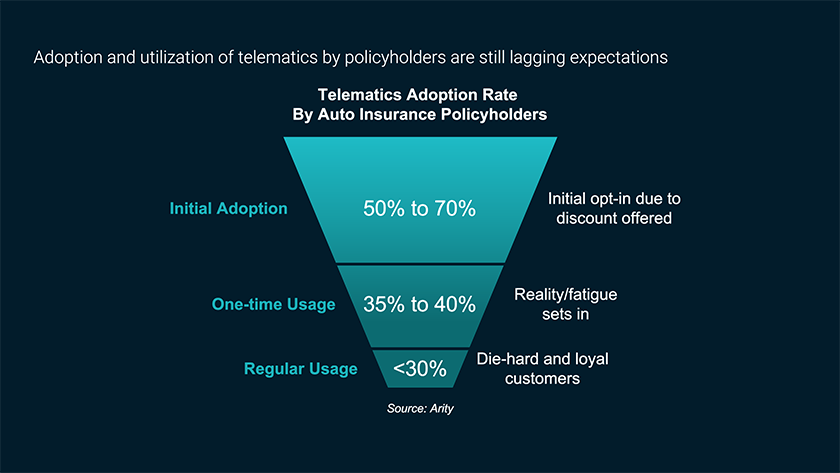

Even those actively promoting telematics struggle to realize its full potential. While telematics has been used by auto insurers since the 1990s, it’s been primarily centered around upfront discounts and participation through a carrier’s own app. This approach has limited its effectiveness.

The illustration below reflects the current adoption and utilization rates of telematics by most carriers:

Nevertheless, the insights that telematics can offer into actual driving behaviors and its potential business impact are indisputable.

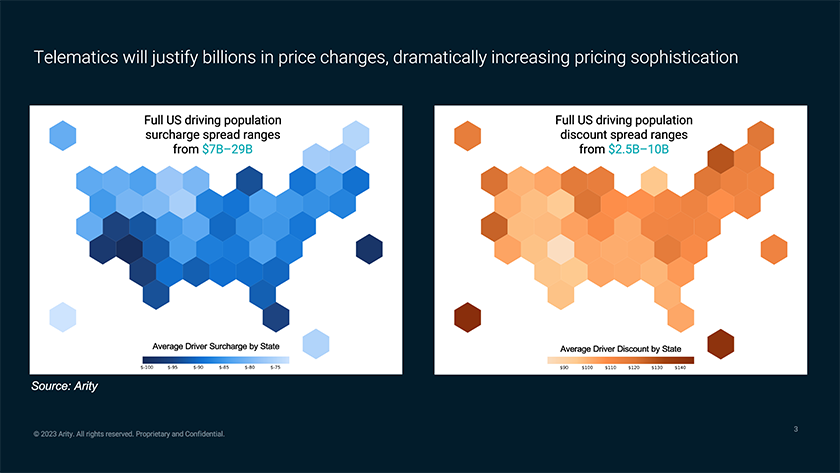

Arity analysis shows that telematics could potentially deliver up to $39 billion in pricing sophistication for the U.S. auto insurance industry.

Specifically, the next illustration breaks down the potential surcharges of up to $29 billion for risky drivers on the left side and discounts of up to $10 billion for safe drivers on the right side. These staggering figures are based on Arity’s analysis of the driving behaviors of over 35 million U.S. drivers and more than 1.4 trillion miles of their driving data.

With such a promising potential business impact, many auto insurers are re-examining ways to better leverage telematics to overcome current macroeconomic challenges AND build long-term success. With this as the backdrop, three Arity experts and a McKinsey partner joined forces for the PropertyCasualty360 (PC360) webinar, “Unlocking the Full Potential of Insurance Telematics.”

During this webinar, these experts shared four key insights that can serve as the guideposts for the auto insurance industry:

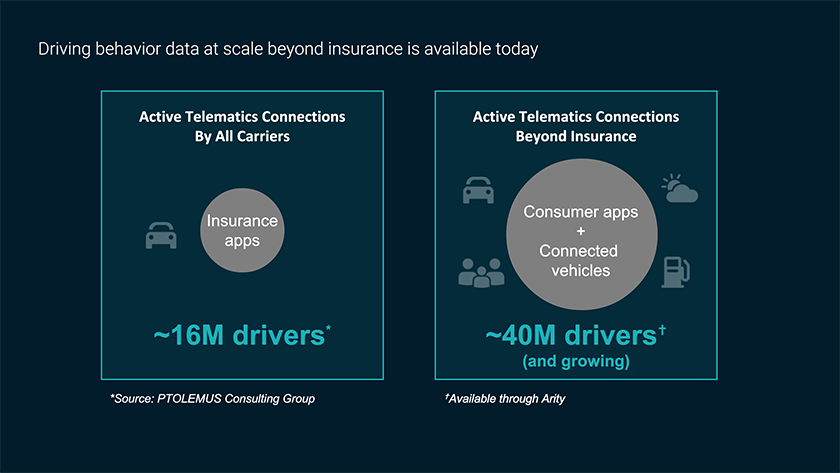

Telematics data for a significant percentage of U.S. drivers is accessible now. Arity is collecting over 1.1 billion miles of driving data across the U.S. DAILY. Through partnerships with mobile app companies, automotive manufacturers, and tech firms, Arity has made it much easier and cost-effective to access the largest driving database on-demand (via the Arity IQ℠ network).

With high smartphone adoption and growing acceptance of data-sharing among U.S. consumers, auto insurers are recognizing that people are increasingly willing to share their driving data with non-insurance apps. By emphasizing the broader benefits of telematics – such as improved driving behavior, expedited emergency assistance, and faster claims processing – consumers are starting to shift their perception of telematics from intrusive to attractive. This positive feedback loop is creating a win-win proposition that can benefit both auto insurers and consumers, thus moving them away from viewing telematics solely as a participation discount tool.

To unlock the full potential of telematics, auto insurers must first utilize driving data strategically — particularly at the point of sale to improve pricing sophistication. Not doing so could leave $39 billion on the table. This important first step marks just the beginning of the telematics adoption journey.

By effectively segmenting and targeting consumers based on actual driving data, auto insurers can further identify and target consumers with the optimal lifetime value, while simultaneously improving profitability with risk-adjusted premiums at the point of sale.

Taking it a step further, auto insurers could leverage telematics to greatly improve their customer experience, especially during the claims process if an accident ever happened. With our focus on making transportation smarter, safer, and more useful for everyone, Arity offers a comprehensive suite of telematics-based solutions to help auto insurers better serve their policyholders throughout the customer journey.

Doug McElhaney at McKinsey made an important parallel about the commercial fleet operators who rely on telematics for data-driven risk management. Specifically, the use of telematics is widespread and, in many instances, mandatory. Their business rationale is to protect their most important asset, which is the fleet vehicles. I would argue that auto insurers must embrace the same mindset by leveraging telematics and driving data to protect their customers and their insured personal automobiles.

If you want to learn more about how to unlock $39 billion of pricing sophistication and gain other nuggets of insight, watch our PC360 webinar.