Driving behavior data: The new frontier for smarter auto insurance pricing Read article

“Barbenheimer” was so last year for pop culture, just like how “returning to profitability” was so last year for auto insurance. I remember it distinctly – I couldn’t go on Instagram without seeing promo for those two movies, and I couldn’t go on LinkedIn without seeing industry-wide grievances about profitability from my network of auto insurance professionals.

But life goes on, and we’ve already moved on to the next big thing in 2024. For auto insurance carriers, that’s “Growth.”

This isn’t breaking news by any means. Along with other industries, auto insurance took a hit with the COVID-19 pandemic – which, unfortunately, took years to fully bounce back from.

As the telematics partner for many leading insurers, just last year, our team was having discussions around how telematics data can be used to price risk more accurately. Of course, that was all in the name of helping partners return to profitability quicker.

Telematics data available at time of quote through the Arity IQ℠ network was exactly what many of our partners needed to return to a stable, profitable state. And happily for the industry, things have started to turn around with a $9.3B underwriting gain in Q1 of 2024, compared to the $8.5B loss in Q1 of 2023. So, this year, our conversations have taken a positive turn as our partners start to re-prioritize growth.

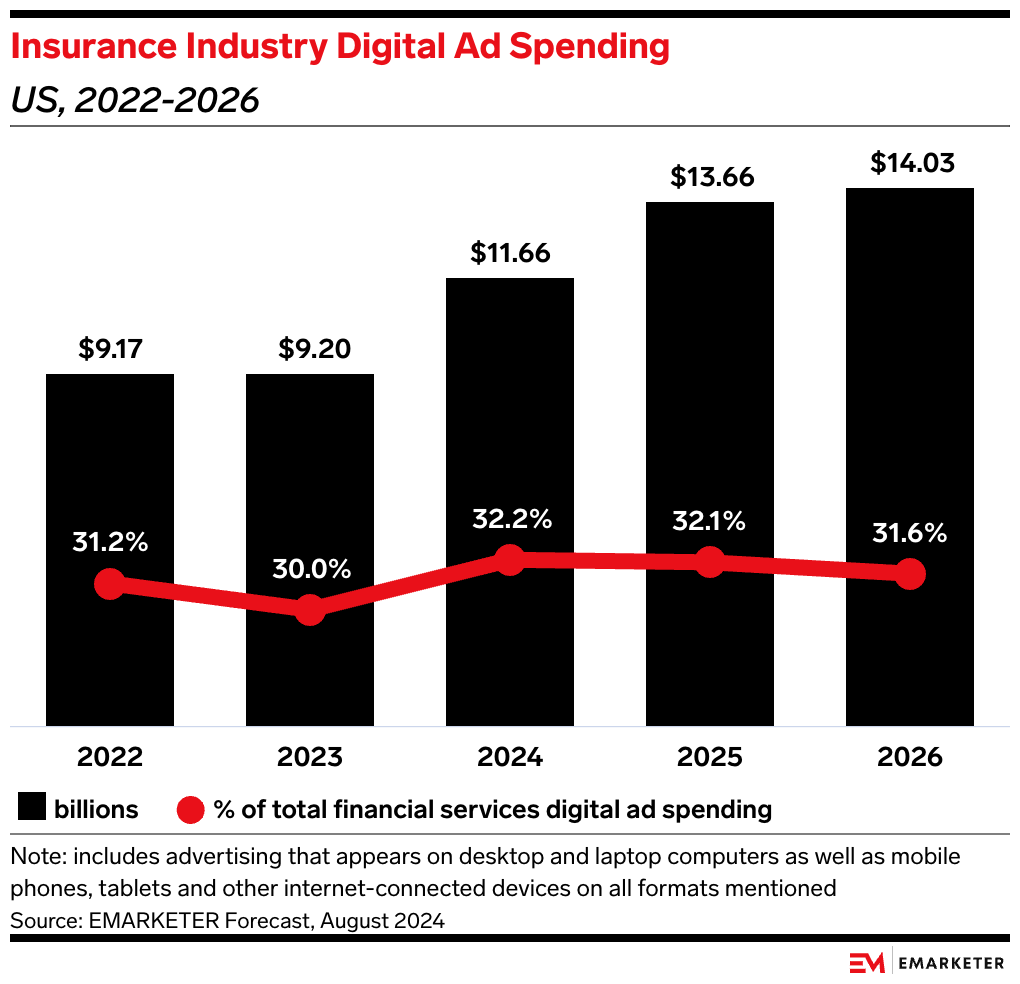

Very early on in the year, carriers were getting comfortable with the “G” word again. And as of October 2024, eMarketer reported insurance is the leading sector for digital ad spend in the financial services. In fact, insurance was the only sector to increase its share of digital ad spend from 2023-2024, growing from 30% to 32.2%.

However, as advertising ramps up, it’s important carriers think about growth in a smarter, more strategic way. After all, the lesson we’ve all learned is how quickly the state of the industry can change. So, what can auto insurance carriers do to make sure they’re thriving even when there’s a downturn?

Once again, telematics data can help.

You may already be leveraging telematics data for pricing new business, but did you know you can reach nearly 175M U.S. drivers based on how, when, and where they drive through the Arity Marketing Platform?

The Arity Marketing Platform, powered by Transparent.ly leverages the largest set of telematics-based driving data for U.S. insurers, enabling marketers to target prospects across the customer journey.

With a strong focus on both profitability and growth in 2024 and beyond, here are five reasons why telematics for growth marketing is the next big thing for auto insurance.

With telematics data, auto insurance marketers can segment and reach new customers based on how, when, and where they drive. Most importantly for this industry, they can segment based on driving risk, where risk category 1 represents the lowest risk drivers and risk category 10 represents the highest risk drivers.

And targeting drivers based on driving risk levels can be a powerful tool toward optimizing profitability. Arity’s Tier 1 drivers are expected to be over 14% more profitable than average and are expected to have a 1% higher retention rate than average.

Along with driving risk, with the Arity Marketing Platform, carriers can reach customers based on other relevant factors like how many miles they drive and how likely they are to churn. They can also target based on demographic, psychographic, and behavioral qualities, such as age, gender, household income, shopping patterns, vehicle ownership, insurance status, and more. This empowers carriers to reach their different customer segments more strategically.

In addition, these valuable insights can make sure you’re engaging customers with the right message – i.e., one that can turn a prospect into a customer. With telematics data, you can tweak messaging depending on who you’re talking to. This can look like advertising competitive rates to safer drivers, while promoting accident forgiveness and roadside assistance to riskier drivers.

With the Arity Marketing Platform specifically, auto insurance marketers can leverage our partner mobile apps to optimally target segments and use custom creative to drive engagement. They can also expand campaigns to Arity’s owned and operated (O&O) sites and partner sites, maximizing reach to ensure no valuable customer is missed.

Overall, telematics data helps carriers make the most out of their ad spend. Instead of casting a wide net and seeing who sticks, these insights enable marketers to strategically reach customers – all while driving more clicks, quotes, and binds.

Ready to revolutionize your growth marketing strategy? Contact us to learn more about our telematics-based marketing platform.