Driving behavior data: The new frontier for smarter auto insurance pricing Read article

With a driver’s permission, insurance companies can leverage driving data to customize consumer pricing and experiences in valuable and sophisticated ways. For example, insurers can provide reduced or fairer premiums based on actual behaviors, rather than only proxies. Or they can provide incentives or bonuses based on how or where an insured drives.

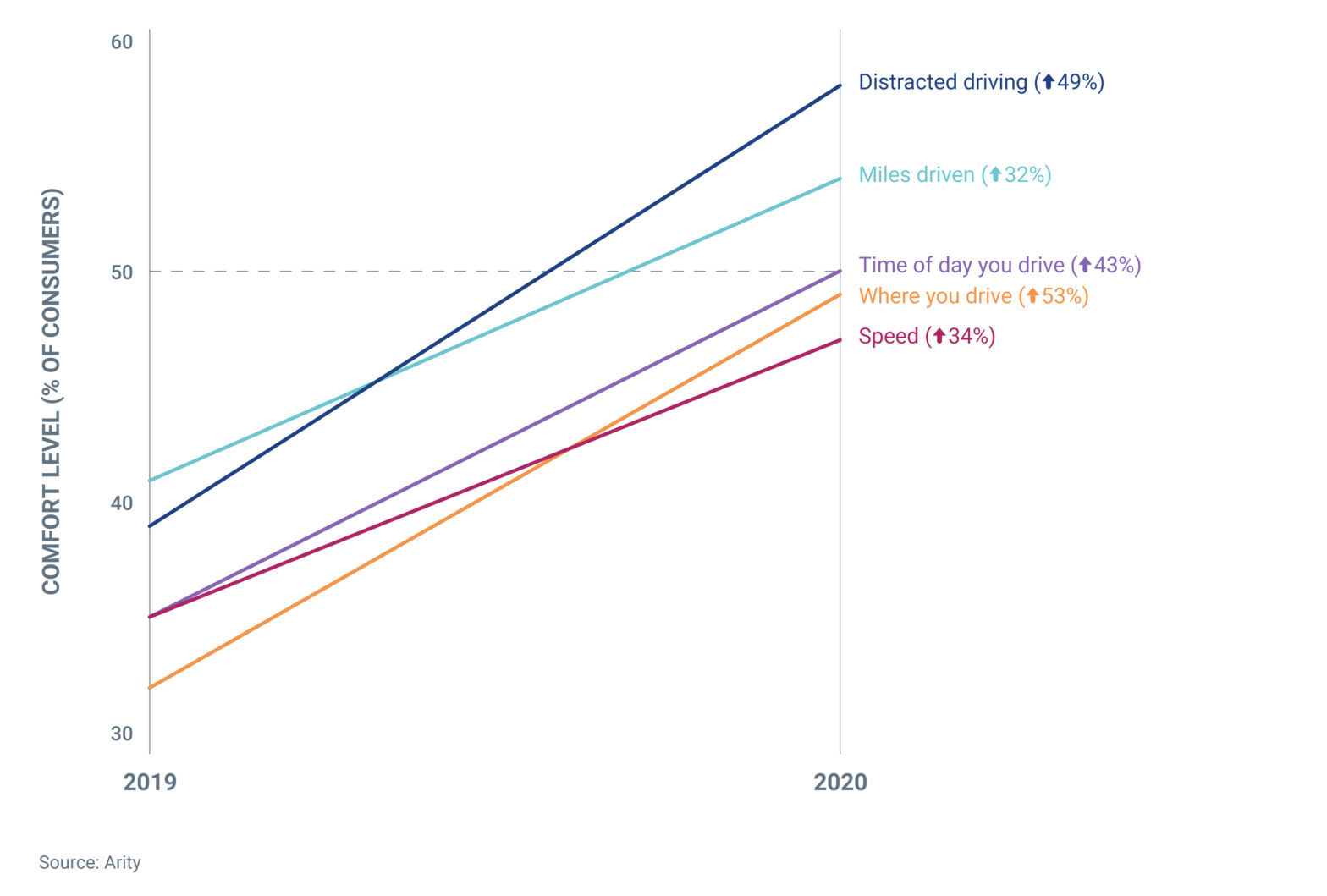

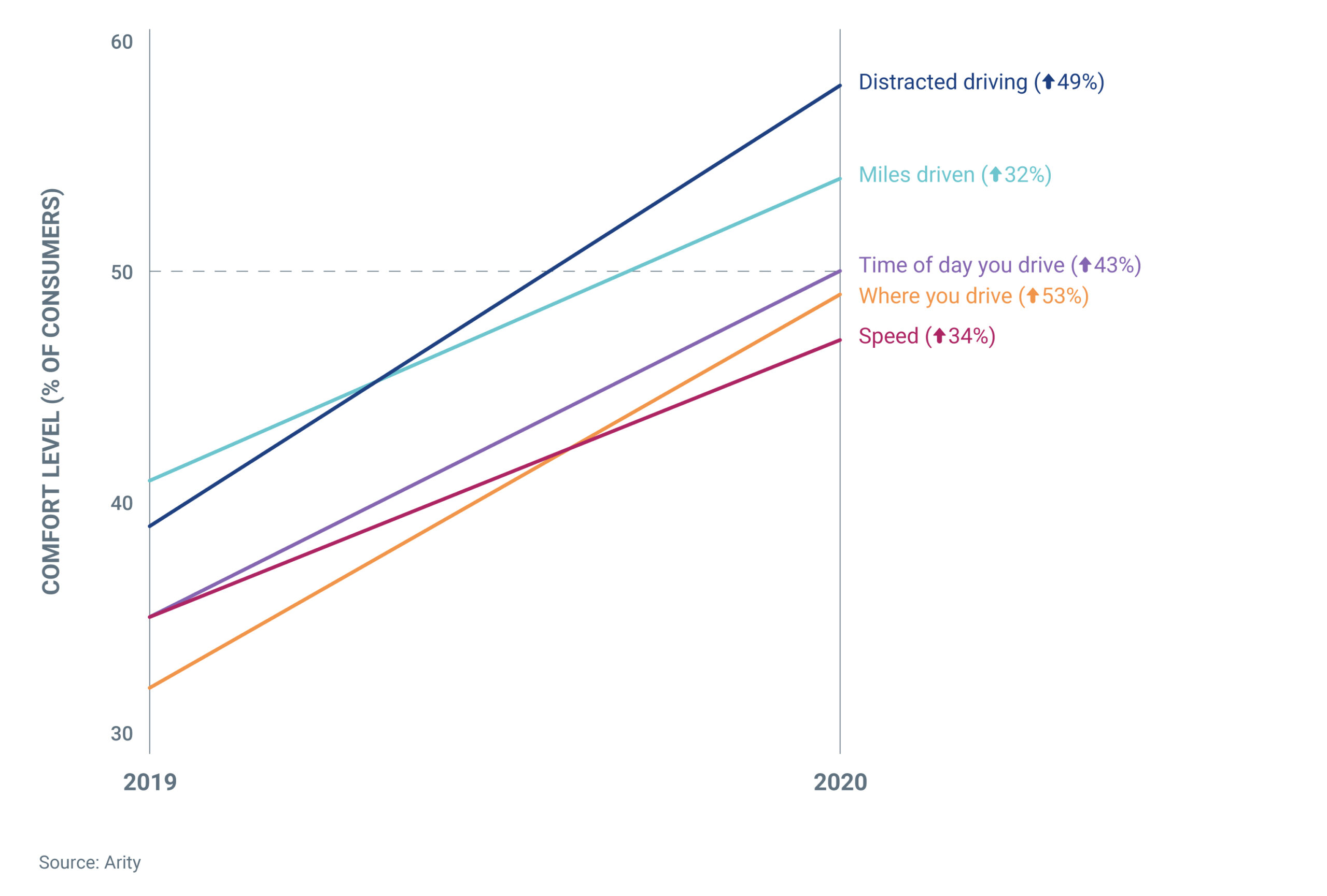

Despite the benefits, however, drivers are not always comfortable with sharing what they feel is sensitive, personal information about when, where, and how they drive. Over time, insureds have grown more comfortable with sharing their driving data, but historically the progress has been relatively small; at Arity, we’ve tracked gains of about 3% year-over-year. But in 2020, in part due to the COVID-19 pandemic, we’ve seen this mindset change dramatically and a new, unprecedented acceptance of telematics emerge.

Here’s a little background: in May of 2019, Arity surveyed 875 licensed drivers over the age of 18 to find out how comfortable they would be with having their insurance premiums adjusted based on typical telematics variables including how many miles they drive, distracted driving, speeding, and when and where they drive. About 30-40% of the participants indicated they would be either very or extremely comfortable sharing this data in order to optimize their insurance premium. Not bad, but that still left most drivers unwilling to opt-in.

Then in May of 2020, we re-ran this survey with more than 1,000 licensed drivers. This time, about 50% of drivers were comfortable with having their insurance priced based on the number of miles they drive, where they drive, and what time of day they drive, as well as distracted driving and speeding. This is a year-over-year increase of more than 12%.

In other words, instead of only a third of consumers being comfortable with being priced on their driving behaviors, now approximately half of customers would be willing to opt into a telematics program. That’s a huge shift!

Consumer comfort with telematics increases dramatically

Compared to 2019, consumers are significantly more open to being priced on their driving behaviors

Everything, really. Arity multi-source trip data showed considerable changes in how and when people were driving when the first wave of the pandemic led people to self-quarantine in March 2020. Most notably, driving across the U.S. dropped significantly. This data, in part, helped spark the trend of insurance carriers offering refunds to their policyholders.

These paybacks were widely covered by the media, including Forbes, so consumers became aware of the potential savings, even if their own insurer didn’t offer a discount. And although we, within the industry, know that the risk associated with miles driven isn’t a one-to-one correlation, it certainly has a significant impact, and it’s interesting to see consumers gaining a deeper understanding of this. Between awareness of the refunds and of their own decreased driving, customers began to expect a price reduction if they decreased their miles driven.

Consumers also became even more price-sensitive this year. They see their cars sitting idle and are often under increased financial strain as a result of the pandemic, but they’re still paying a lot in insurance premiums, even if they did receive a rebate check. About 40% of drivers shop for auto insurance each year on average, but with increased interest in reducing household costs, Arity research shows that more people are shopping around and they’re also more likely to switch.

Now more than ever, we’re also finding that insureds are expecting carriers to offer more customization. In fact, “four [out of] five insurance consumers are willing to share their data in return for personalized services,” according to a 2019 Accenture study. Customers want offers, services, and products that are customized to fit their unique needs, such as:

With upwards of half of consumers now indicating acceptance, the time has never been better to leverage telematics and driving behavior data. Whether it’s supporting marketing and acquisition or creating more sophisticated, personalized pricing and product experiences, this unprecedented consumer mindset shift could be game-changing, and companies that take advantage of it stand to benefit considerably in everything from growth to profitability.

Learn more about our mobility data solutions.