New Year’s Eve driving behavior trends 2025 Read article

As states across the country evaluate what’s safe to reopen, Arity is evaluating how continual changes in consumer preferences are also changing driving behaviors. For example, are more people using gig platforms like Instacart and DoorDash for groceries and meals? Are there more delivery drivers on the road?

To start answering questions like these, Arity has been analyzing how driving for gig platforms has compared to personal driving, driving to commute, or for leisure that is unrelated to job duties.

While circumstances continue to evolve, our initial look at trips between February and August 2020 gives us a sense of how mobility will change going forward.

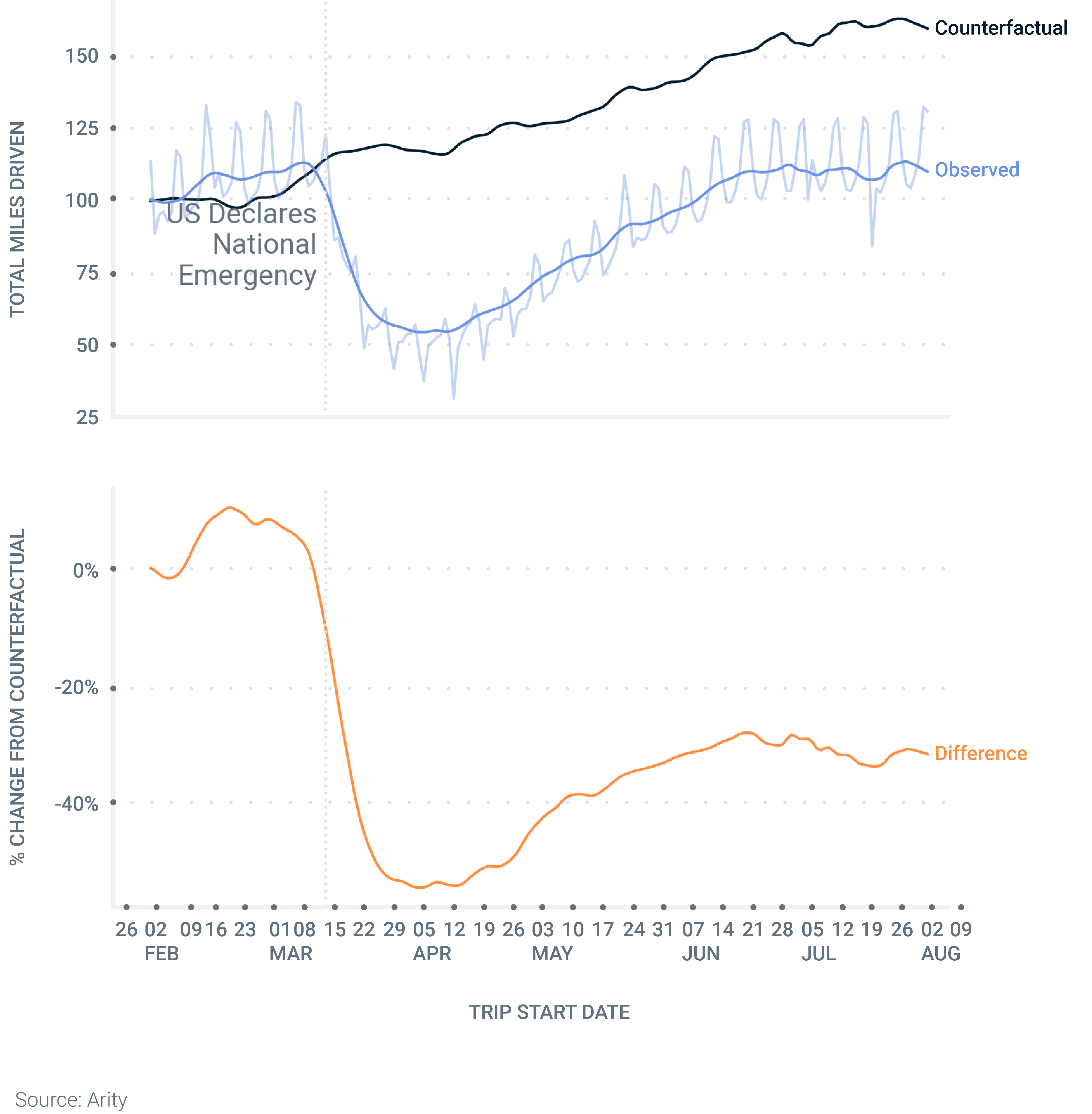

As previously discussed in a blog post, Arity analyses show that total miles driven declined by more than 50% countrywide in late March, and even now with more businesses open, total miles driven remain about 30% lower on average.

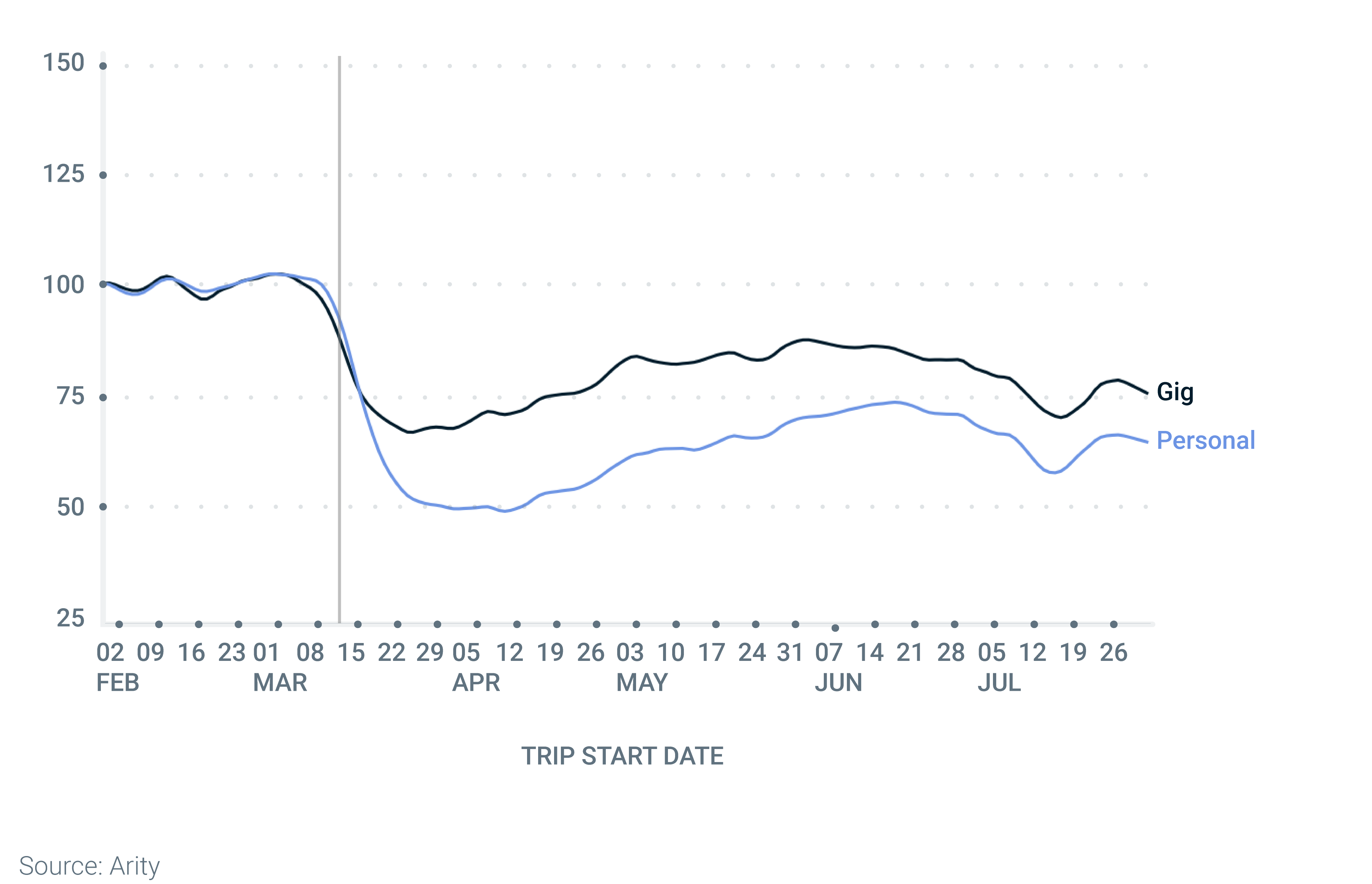

To understand how the pandemic has affected driving for gig platforms specifically, Arity analyzed when people were driving for personal reasons vs. for gig platforms. We identified gig trips using our gig detection model that applies machine learning on multiple sources of telematics data to discern personal from gig driving.

Separating types of trips with Gig Detection, we see differences between the declines in personal vs. gig driving at the start of stay-at-home orders in March. While personal trips dropped by 50%, gig trips dropped by only 30% during this time, suggesting greater motivation to drive for gig work than there was to drive for personal reasons. And while there were fewer gig and personal trips overall, gig trips made up a greater percentage of trips on the road – reinforcing the demand for gig work to continue, despite worries about health and safety for delivery drivers.

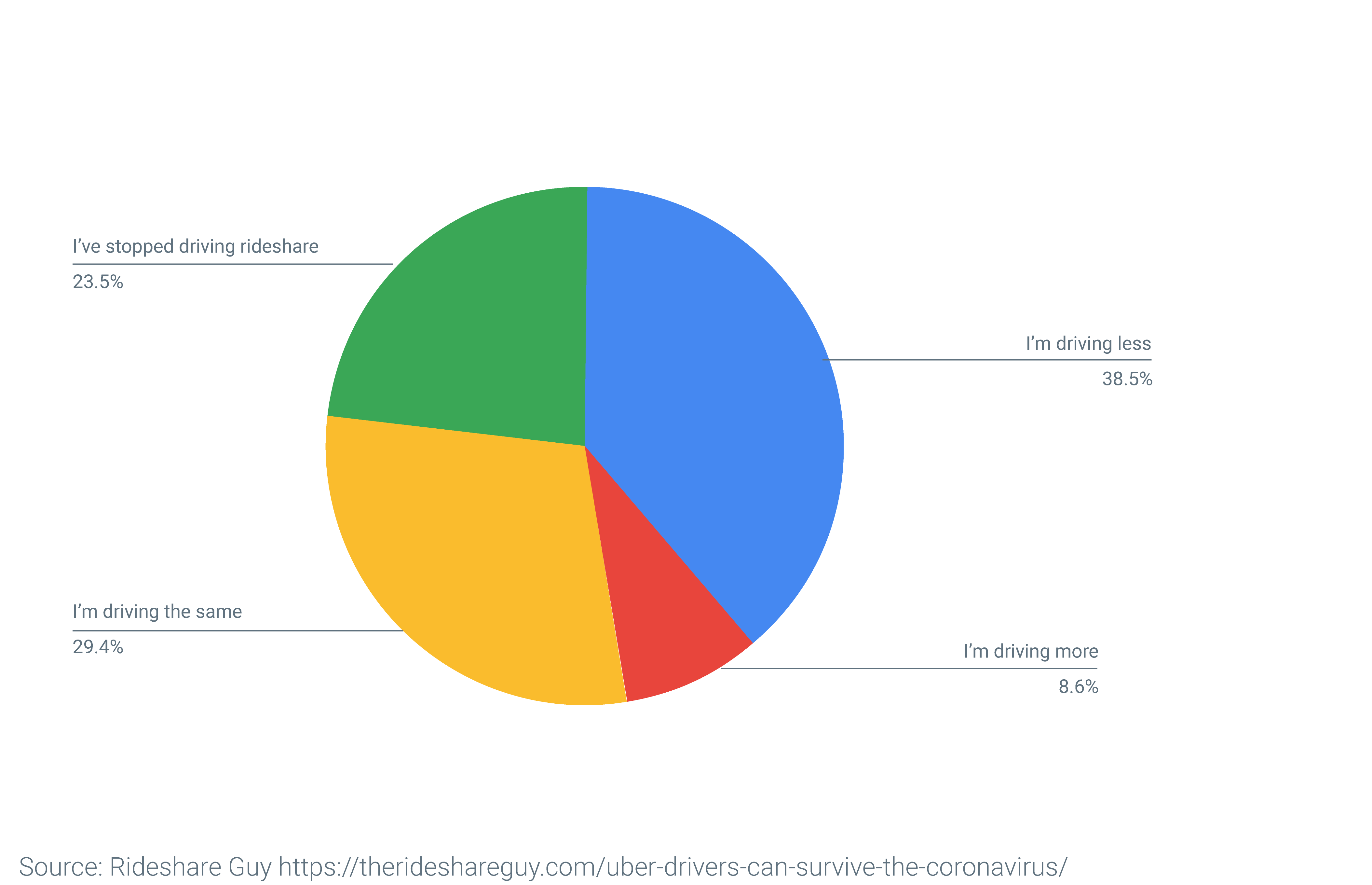

While gig platforms incentivize drivers to accept work, mounting concerns about health and safety for delivery drivers are impacting their decision to take rides. According to a survey gathered by the Rideshare Guy, 39% of drivers said they were driving less due to the coronavirus.

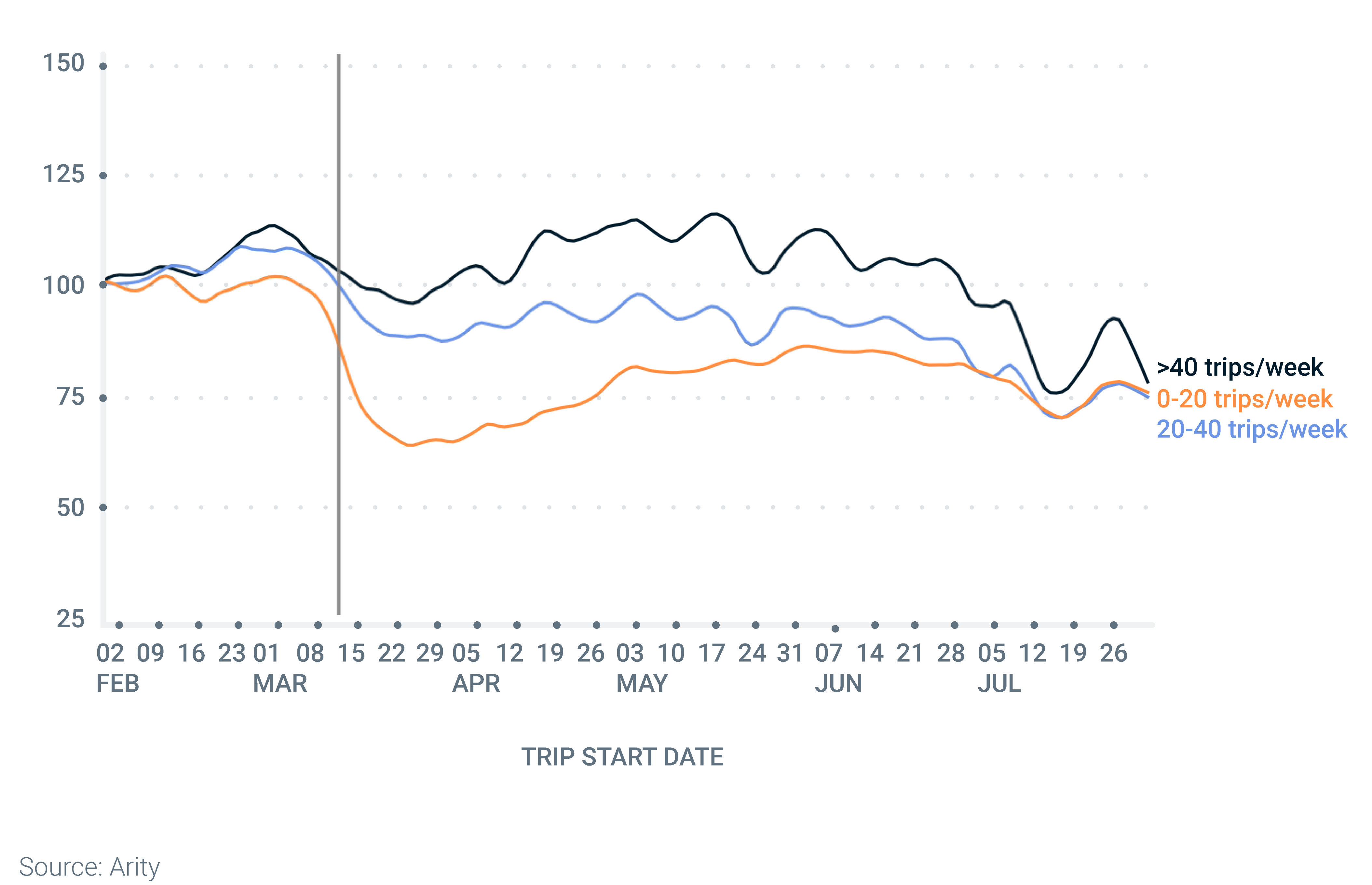

To put these attitude shifts into context, we analyzed which types of gig drivers were more likely continuing work despite stay-at-home orders. We noticed that drivers that were more active on gig platforms before the pandemic continued to work the same amount even after March. However, we saw the opposite for gig drivers that drove less than 40 trips per week who, on average, drove 35% fewer trips for gig platforms than before stay-at-home orders.

What are the big takeaways here? While changes on the roads are still unfolding, our analysis reveals patterns that suggest how the gig economy is responding as the pandemic changes the dynamics in our individual and economic relationships.

What happens next? We need to keep our eye on changes in transportation to evaluate demand for gig platforms as the economy adapts to the “next normal.” Arity will remain focused on how our data reflects demand for auto aftermarket goods, services, and travel. And we’ll expand our analysis of geographic variability as states take different steps forward in these unprecedented times.

Learn more about our mobility data solutions.