Driving behavior data: The new frontier for smarter auto insurance pricing Read article

The word frequency holds a lot of different meanings. In general, it’s the rate at which something occurs over a period of time. For digital advertisers, it’s known as the number of times a user has seen an ad in a set timeframe. But for auto insurance carriers specifically, it refers to something entirely different – a KPI that can be much more insightful than the number of ad views.

Here are three need-to-know facts about frequency for auto insurers:

Frequency for auto insurers refers to the average number of collisions and claims filed by customers after signing a policy.

To measure frequency to determine an advertising campaign’s success, a carrier would take a campaign (for example, one with targeted messaging to optimize for low-risk drivers) and monitor those converted customers separately from all others. Ideally, the number of collisions and claims for that group would be measured over at least a six-month period. From that data, a carrier can measure whether the campaign was a success.

Not only is claims frequency a more insightful – and therefore a more valuable KPI than ad views, clicks, quotes, or binds – but it can also be a shorter-term proxy for customer lifetime value (LTV) which can take years to truly measure.

Wouldn’t it be nice to know, in a much shorter timeframe, which ads are successful at reaching the most valuable customers and resulting in the highest ROI?

In this period of increased auto insurance shopping and switching, it’s a smart move to invest in reaching your best customers right now.

The Arity Marketing Platform is a great place to start, enabling carriers to customize messaging to the exact customers they seek by targeting based on actual driving risk behavior.

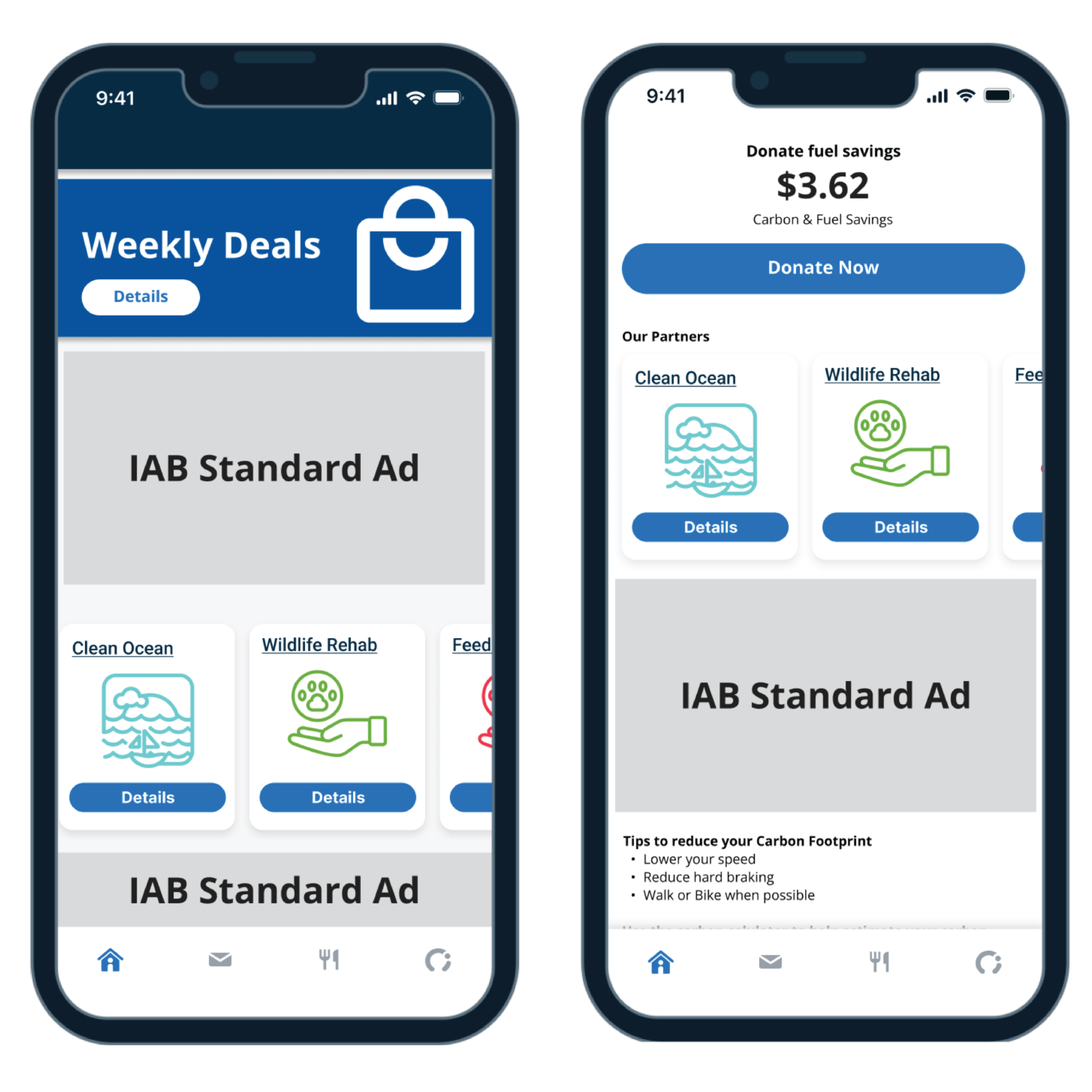

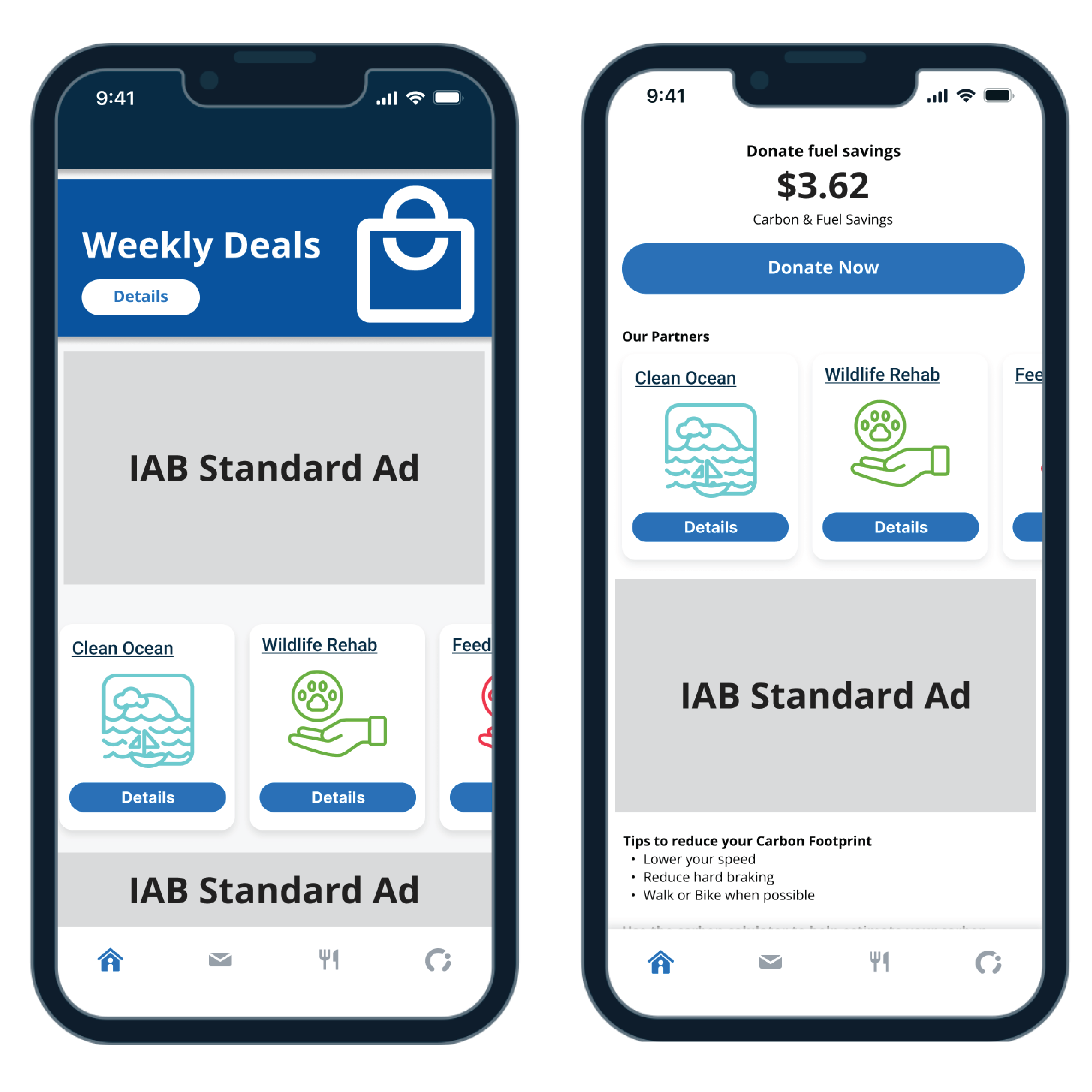

The Arity Marketing Platform is the nation’s first and only driving behavior-based mobile advertising network, connecting insurers with millions of validated drivers through a network of mobile apps.

If a carrier wants to target the lowest risk drivers, which have a higher LTV and can be up to 5x more profitable than average, that carrier can use the Arity Marketing Platform to reach those customers with the right messaging, at the right place, at the right time. For instance, for those low-risk drivers, you would reach them with:

With the Arity Marketing Platform, auto insurance marketers can take the guesswork out of their campaigns and follow the data to their best customers – ultimately lowering frequency and boosting ROI.

Ready to learn more? Read our blog on how to launch your programmatic advertising campaign, or contact us to start a conversation!